Truth in Savings Disclosure

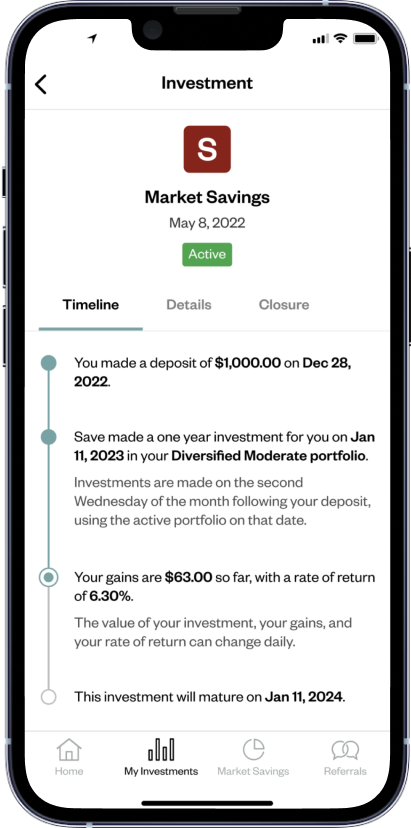

Generally, an APY (or annual percentage yield) is the yearly return on a bank or investment account. Save Market Savings is a hybrid product and service that includes a deposit account linked to an investment product. The deposit account portion of the Save Market Savings product and service is provided by Webster Bank, N.A., Member FDIC; and is non-interest bearing with a 0% APY. The investment portion of the Save Market Savings product and service offers the potential to earn an APY with a variable rate (Variable APY). The Variable APY, if any, is derived from the investments made by Save on behalf of the customer within Save’s portfolio of strategies over the duration of the term length selected by the customer. The Variable APY, if any, will be equal to the cumulative return for the investments selected for you by Save for the term selected on the applicable maturity date. The Variable APY may be 0% but will never be less than the Minimum Variable APY of 0% per annum. Assuming a minimum Variable APY of 0% per annum, if the Variable APY applicable to a particular maturity date is less than or equal to the Minimum 0%, the customer will not receive any Variable APY return for that investment upon maturity. Variable APYs are subject to change at any time. Variable APYs are not guaranteed. The Variable APY presented is hypothetical in nature and reflects the potential growth that could accrue if the investment is held for the entire term selected. The Variable APY advertised and presented for the Market Savings Program is based on historical performance in the S&P 500 Risk-Controlled Portfolio from 2009 to present and reflects the potential growth that could accrue if the investment is held for the entire term selected. All other Save portfolios (Non-S&P 500) present a Variable APY which is hypothetical in nature, based on hypothetical back-tested performance, and reflects the potential growth that could accrue if the investment is held for the entire term selected. All back-test statistics are hypothetical and have been designed with the benefit of hindsight. For more detailed information please see Hypothetical Back-testing. Variable APYs presented for all portfolios are shown net of fees. Both Historical performance and Hypothetical back-tested performance are no guarantee of future performance and actual results will vary.

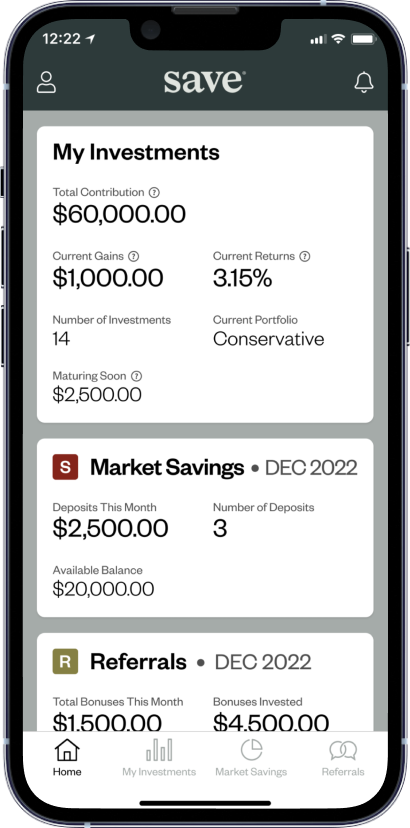

The minimum deposit amount is $1,000 for the 1-year term and $5,000 for the 5-year term. Deposits are FDIC-insured up to the maximum allowed by law, $250,000 per depositor, per bank. Management Fees associated with the investments may reduce earnings on the account. Customer withdrawal prior to maturity could result in additional associated costs.